I don’t think I would want to live here.

One thing you will never hear a serious investor say is, “If I wouldn’t live in it, I wouldn’t buy it”. Well if you are accustomed to living in houses that are over 2000 sqft, with large rooms, gas cooking and located in Chesterfield you may not want to live in a 3 bedroom 2 bath 1300 sqft. rancher in the West wood area. However, you could get close to $1,500 per month in rent. Relative to this example, if you look at different areas of any city you can find lower income housing that is generally under $130,000 and creates very good cash flow opportunities.

Let’s go through North Side, different parts of Church Hill or South Richmond. In these neighborhoods you will find and wide variety of sizes as well as architectural designs. There will also be a wide variation in pricing and quality. Some houses will need lots of work but can be purchased at the lowest of prices. In other cases you find conditions that range from needs work all the way to move in ready. Of course, prices will vary accordingly.

However, the point is that these price points create the greatest opportunity for immediate cash flow, whether as rentals or flips. The other upside is that if things go south your debt is manageable.

The pie in the sky guy

So you are excited that the market has turned around and you just finished a free book on real estate investments, that has you highly motivated to get into the market, especially because you can do it with “no money up front”. Well, lets see, will the bank loan you money without a down payment? Probably not. Can you get an FHA loan on investment properties, with no money up front? No. Perhaps a hard money lender? “What’s a hard money lender”? A hard money lender is a lender who will loan money at higher than normal market rates, for shorter periods of time . However, in most cases the lender will have fairly tough criteria, that can include issues with crime statistics and return on investment requirements that are incumbent upon evaluation appraisals. The strict criteria make deals to difficult and time consuming.

Now it doesn’t seem quite as realistic. Don’t misunderstand, it can be done. However, in most cases you have to find the perfect combination of being priced right, with room for a profit margin, in a fairly good neighborhood and in the right condition. And after all of that here’s the kicker, there are tons of other investors out their who are looking for the same thing and can perform quicker because at these price points there are plenty of investors with either the cash or access to the credit lines that can move these properties quicker than the investor who is investing with no cash up front.

Time to make the move

All that being said if you are looking to get into rentals and flips, as I pointed out earlier, the best opportunities are generally in the lower price points, because they create good cash flow opportunities, with manageable debit. These properties do require more work at times, they are in most cases older properties and the tenants can create receivable issues. Not everyone is cut out for it. However, if you enter the market with anywhere from $10,000 – 30,000, and can put time equity into the process, you can get into rentals and flips that will create quick returns.

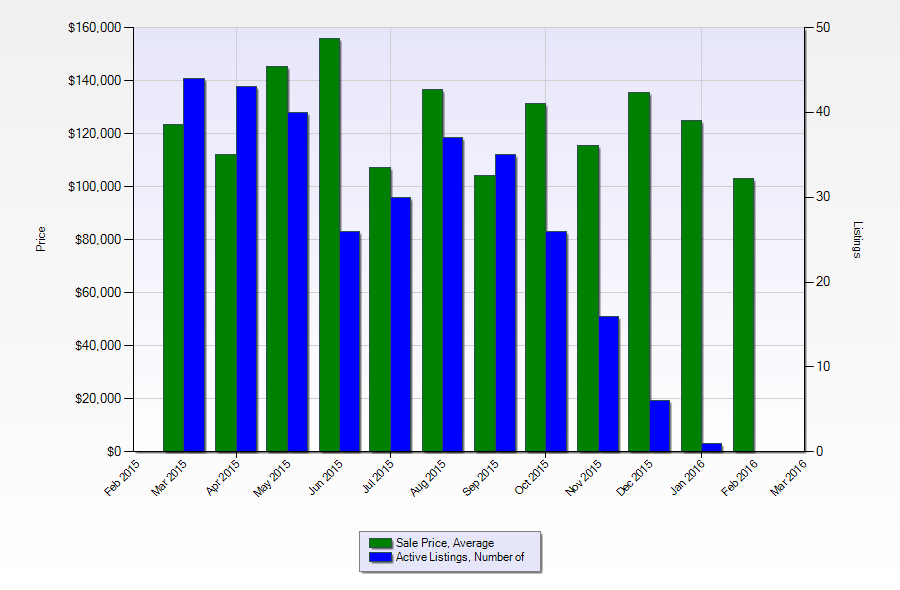

Chart shows the avg. number of listings and avg. sale price for 23222 in 2015 all below 160k

Renters in these price points can generally bring rents from $700 – 1,250 per month. Sec. 8 will offer up to $1500, for certain 4bdrm. rentals and a good flip can yield from 40-60k, depending on rehab budget, sale price and location . The main reason this model works is that there are a large number of buyers and chronic renters in these price points and there is not always enough inventory to satisfy the need.

The return on investment and cash flow are there if you are willing to do the work and spend just a little bit of money. Once you have some financial momentum you will be more likely to move into no money down deals, as well as becoming your mortgage lenders best friend.