When I started to write this article I was asked, “shouldn’t you have done this in January”? Perhaps, though closings that took place in January, minus a few cash accelerated closings, were a reflection of 2015 activity.

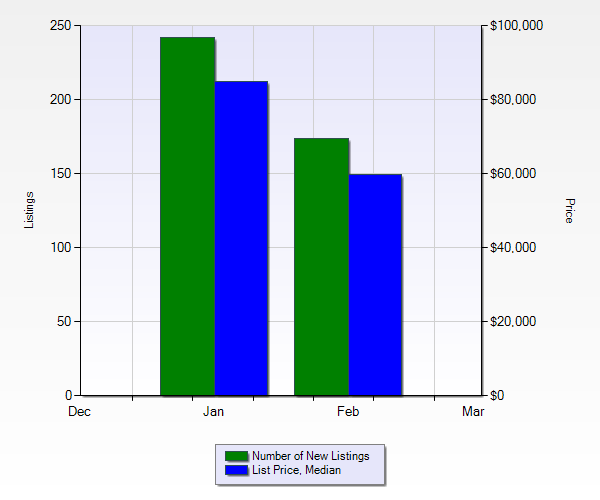

Tracking new inventory and watching what cycles through to pending and sold in the month of January and through this point into February, is a better reflection of what 2016 may become.

Some of my predictions are positive and some predictions not as positive as others, even though the overall prediction is glowingly positive. So here we go.

2015’s activity, was a metaphorical “rope-a- dope”, from April through June, where we saw a remarkable flurry of buyers in an inventory stressed market, shuffle around through bidding wars. Immediately following was July through November when the market seemed to be in intermission, with very little activity.

Though better than Dec. 2014, December of 2015 wasn’t a great month and lead us into 2016, with a lot of the same conditions that drove the market in the previous year.

Currently, housing inventory in the area is low and some say that sellers aren’t selling their homes because they can’t get as much for their properties, compared to their market value in 2007.

In 2015 Richmond had a cost of living that was roughly 5% lower than the national average and an unemployment rate that was around 1% less than the national average. The City is currently in the top 10 of many categories that say, Richmond, VA., is a great place to work, live and play.

Now nearly a decade since the down turn, the Richmond area compared to the rest of the nation has recovered quite well and people are simply not moving away as often. So we have people moving to the area and not a lot of people moving away…The chart below shows, how many months of housing inventory is available. (put your cursor at the end of the line to get current month stats)

During 2016, I believe we will see moderate increases in inventory but not enough to truly be a buyers market. We will see continued competition for quality housing in the most popular areas and continued growth to the south and west, with very little moving east…(slight mistake by the market).

As this trend continues so will the investor growth in the Church Hill area as well as Manchester and North Side in certain pockets.

I think the best new construction growth is going to take place in the Hanover area, as it continues to grow throughout 2016. And that leads to my last prediction, which is that land prices will increase over the year and we will see good growth in new developments of single family homes as well as Apartment and townhouse development.

So, though prices in some areas will continue to rise, the market will still offer good value for the under 300k buyer, while sellers will be able to feel confident about receiving full offers, on properly priced homes.

We will see some growth in inventory, as well as new development and overall growth throughout. Which in the end means we have a strong market and you can feel safe in any position.